Back in August, 2011, I wrote about product teardowns and the immense benefits/insights that they bring.

I was pleasantly surprised to receive an ”investor teardown” in my mailbox recently… this is from a company called CBInsights, which provides insights into how venture capital is being spent and who is spending what, in what spaces, etc.

The specific teardown that I received studied Accel Partners, a leading Silicon Valley Venture firm. It studied investments, exits, focus areas, people, investment patterns, syndication partners, … All very helpful to founders looking for the right kind of investor to partner with.

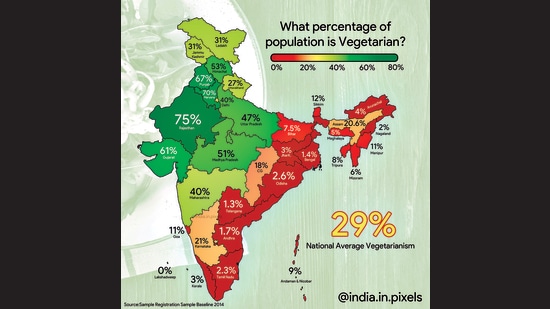

What I liked about the investor teardown was the blending of data, charts and conclusions — making it possible for readers to to get a quick sense, without having to pour through the details. More importantly, it would be almost impossible for individual founders to create this level of insight on their own. The data cleansing and munging alone would make it impractical.